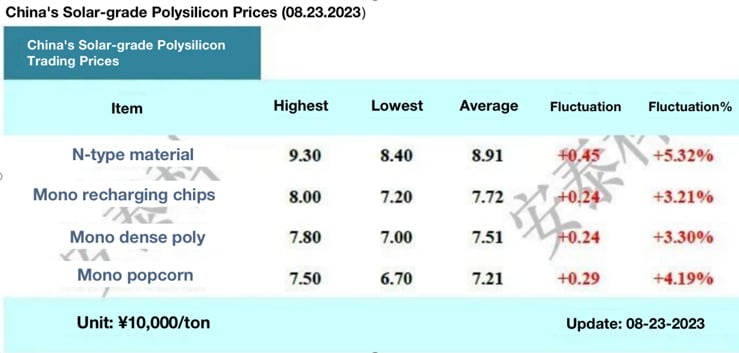

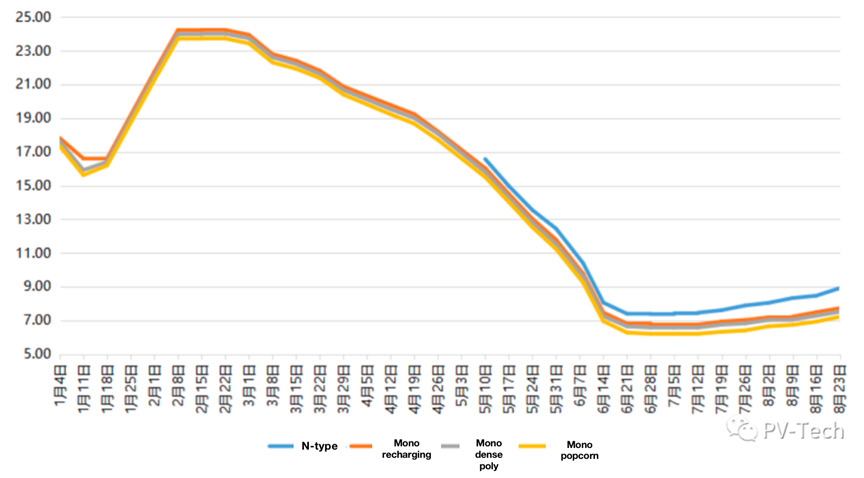

The Silicon Industry Branch of CNMIA published the latest solar-grade polysilicon prices on 23 August, which were on an upward trend.

The transaction price of n-type material was RMB84,000-93,000 (US$11,526.3-12,761.2)/tonne, with an average of RMB89,100/tonne, up 5.32% week-on-week. Mono recharging chips were traded at RMB72,000-80,000/tonne, with the average at RMB77,200/tonne, up 3.21% week-on-week.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The trading price of mono-dense poly material was RMB70,000-78,000/tonne, with an average of RMB75,100/tonne, up 3.3% week-on-week. Mono popcorn material was traded at RMB67,000-75,000 /tonne, with an average of RMB72,100/tonne, up 4.19% week-on-week.

Since the beginning of the second half of the year, polysilicon prices have increased for six consecutive weeks.

The Silicon Industry Branch attributed the rise to the unexpected supply shortage despite some newly added production capacity. Production in August is expected to be flat or slightly higher than that in July. Meanwhile, wafer prices also increased, relieving the burden of the increased cost caused by the mounting silicon prices. It can also bolster the upward trend.

In addition, a total of five companies received new orders this week. Very few companies managed to maintain high turnover, while the other companies only received small or rush orders. From the perspective of market sentiment, downstream enterprises accepted the rising prices well and even showed a higher interest in deal-closing.

On 21 August, TCL Zhonghuan announced its latest quotes, where the prices for various wafer categories increased by more than 3%. It was the third round of price rise since the first attempt on 29 July.

A wider gap between n-type and p-type

The price gap between n-type and p-type has widened, reaching RMB 14,000/tonne. The highest and lowest transaction prices of n-type material were also diverging.

Compared to the price on the week of 16 August, n-type material rose significantly due to market supply and demand, with the transaction prices increasing by RMB4,000-7,000 per tonne, and the average transaction price even exceeding the highest offer last week. The lowest price of p-type material remained unchanged, while the highest price increased by RMB2,000/tonne, and the overall range was between RMB2,000-3,000/tonne.

As the price gap between n-type and p-type materials continues to widen, downstream enterprises start to have different views. Some believe that they should actively procure before any further price increases, while others adopt a wait-and-see attitude as they think that silicon prices cannot maintain long-term growth due to wafer enterprises’ sufficient inventory. These companies also believe that there will still be some time before n-type cells are manufactured and shipped in bulk.